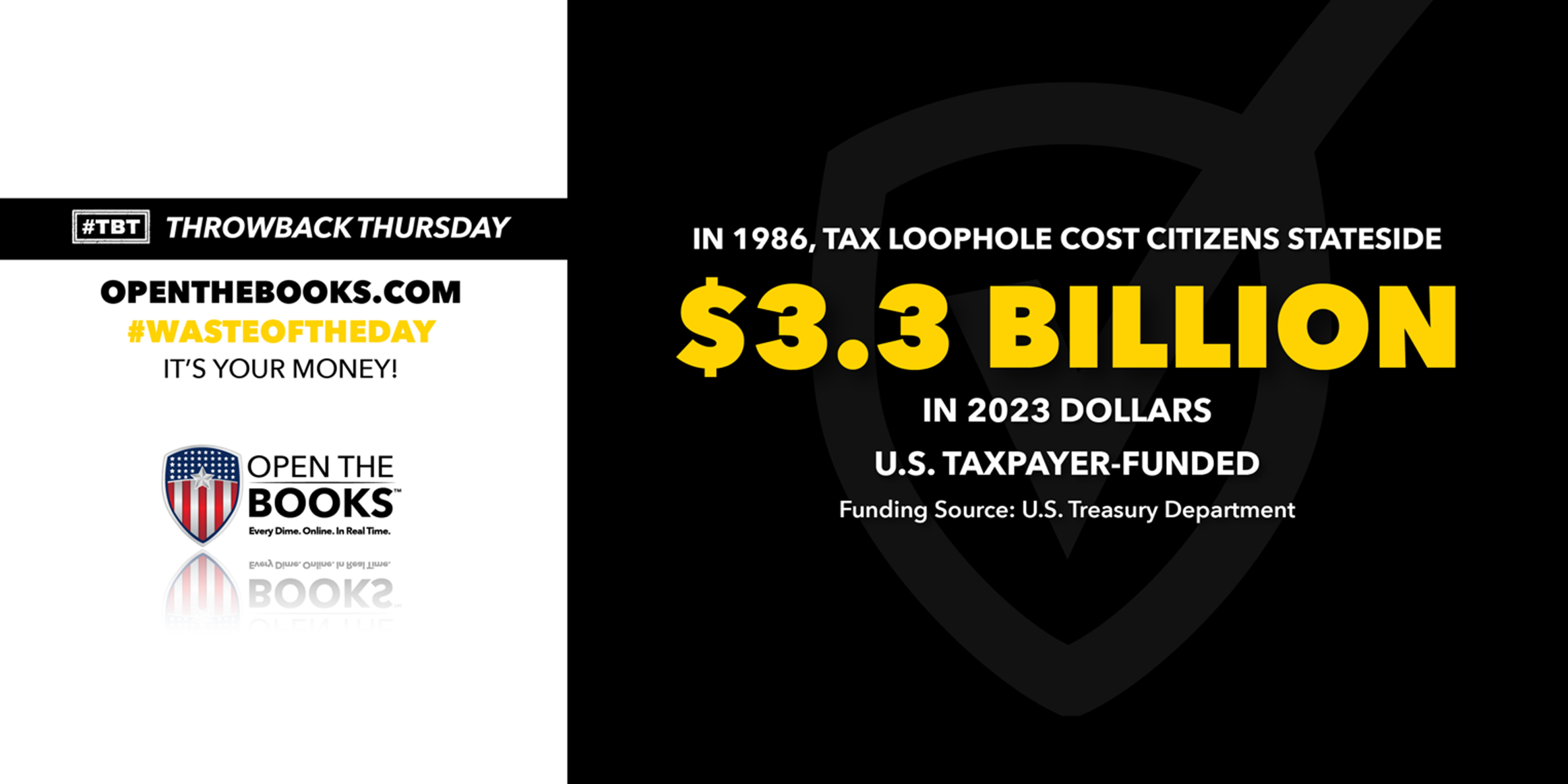

Throwback Thursday: In 1986, Tax Loopholes Cost $1.2B Annually

In 1986, the U.S. Treasury Department allowed large tax loopholes for citizens working overseas, costing Americans $1.2 billion a year — or approximately $3.3 billion in 2023 dollars — and earning the agency a Golden Fleece of the Month award.

Sen. William Proxmire, a Democrat from Wisconsin, gave awards to wasteful and nonsensical spending, eventually handing out 168 Golden Fleece Awards between 1975 and 1988.

The tax loophole allowed citizens living in foreign countries to exclude $70,000 of their income from income tax. “What a nice reward for working in London, or Paris or other hardship posts favored by big multinational corporations,” Proxmire said tongue-in-cheek.

“Charity may begin at home, but when it comes to tax breaks, they get a running start in the old country,” he said. “This loophole is enough to tax the patience of the long-suffering, home-bound taxpayer who may soon see his taxes increase.”

He noted that the loophole began a decade earlier, excluding $20,000 of income and costing the taxpayer $400 million. It since grew to $70,000 per overseas taxpayer, costing $1.2 billion.

“If this loophole were eliminated, [American executives] would have to become lean and mean, instead of fat and sassy,” Proxmire said. “That would be difficult for them but good for the country. And we could sure use that $1.2 billion.”

The #WasteOfTheDay is brought to you by the forensic auditors at OpenTheBooks.com